Yet again, electricity prices are set to be a key point of contention in an Australian federal election.

The Coalition responded quickly to Labor’s election commitment to an emissions trading scheme (ETS), with Prime Minister Malcolm Turnbull warning of “much higher electricity prices” and a “very big burden” on Australians.

Other ministers joined in. Treasurer Scott Morrison labelled the plan a “a big thumping electricity tax” and Environment Minister Greg Hunt branded it “Julia Gillard’s carbon tax on steroids”, warning of “even higher electricity prices for Australian families”.

The centrepiece of the Coalition’s climate policy, meanwhile, is the A$2.5 billion Emissions Reduction Fund. An important element of this scheme is the “safeguard mechanism”, which is due to kick in on July 1 this year. This has implications for the electricity sector and may also affect electricity prices.

These policies will affect the wholesale electricity market, in which electricity is bought from power generators and sold on to retailers and consumers.

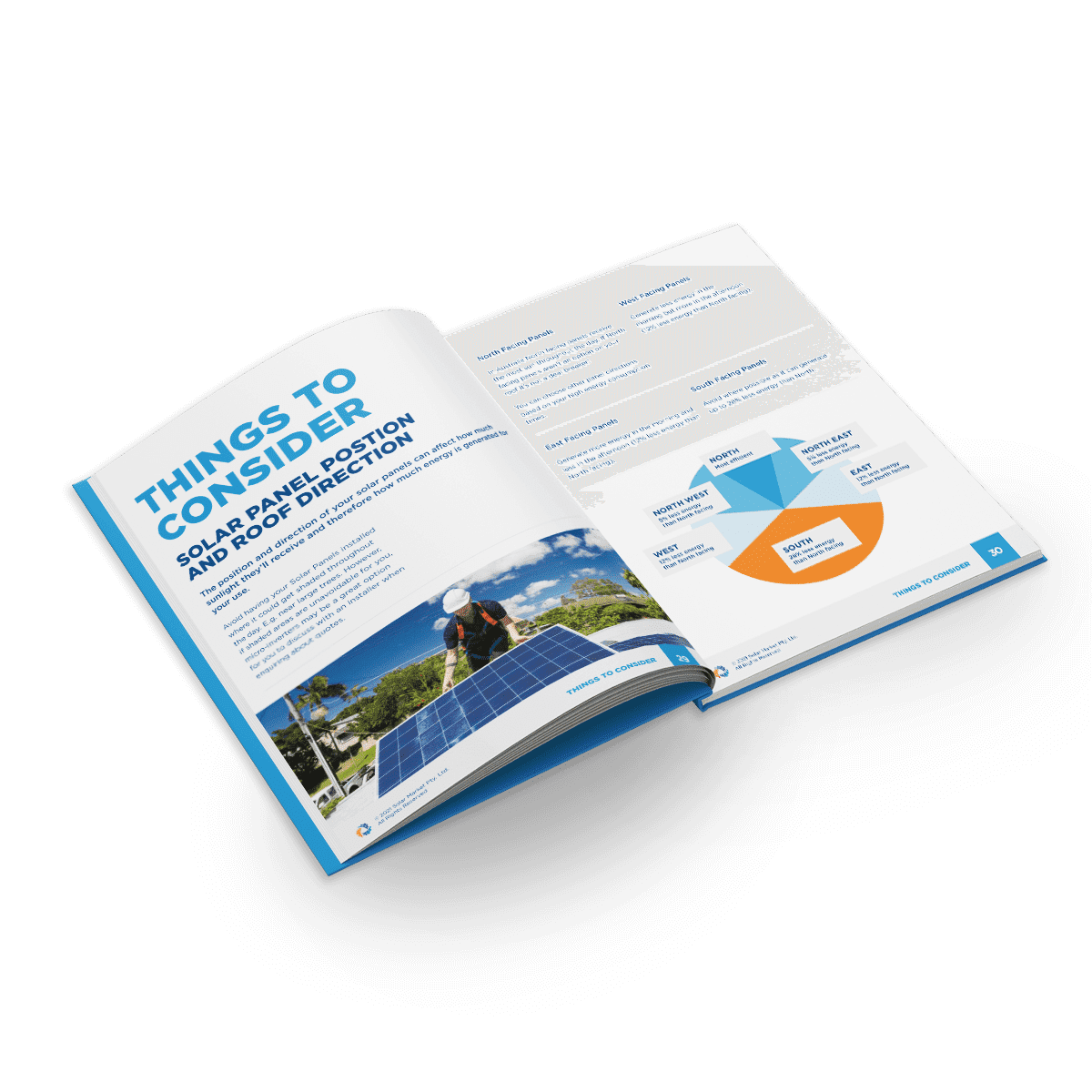

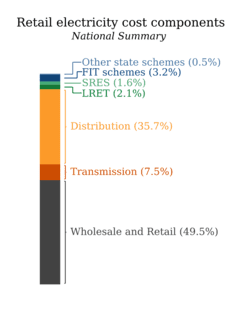

As you can see from the figure to the right, the competitive component of the retail prices makes up about 50% of the typical household electricity bill, and the wholesale component typically makes up half of that. The other major cost is poles and wires.

So how exactly will the different climate policies affect electricity prices?

The safeguard mechanism (Coalition)

The safeguard mechanism will require Australia’s largest emitters to keep emissions below a baseline. This will prevent emissions reductions under the ERF being offset by increases elsewhere. Businesses that go over the baseline will have to pay.

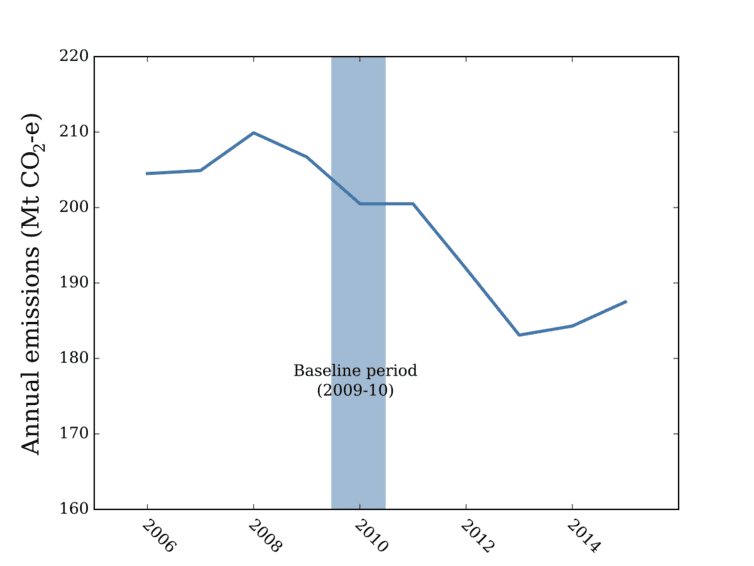

The safeguard is based on the high point in annual emissions from the whole electricity sector between 2009-10 and 2013-14. Generators’ individual baselines and associated penalties only come into play if the whole sector goes over the baseline.

As you can see in the figure below, emissions have fallen by almost 20 million tonnes per year since the first baseline year (2009-10), partially in response to years of declining demand.

Current projections for electricity growth suggest that the baseline won’t be breached for some years. As such, individual generators are unlikely to be penalised, and wholesale prices would not be expected to change dramatically.

Electricity sector emissions trading (Labor)

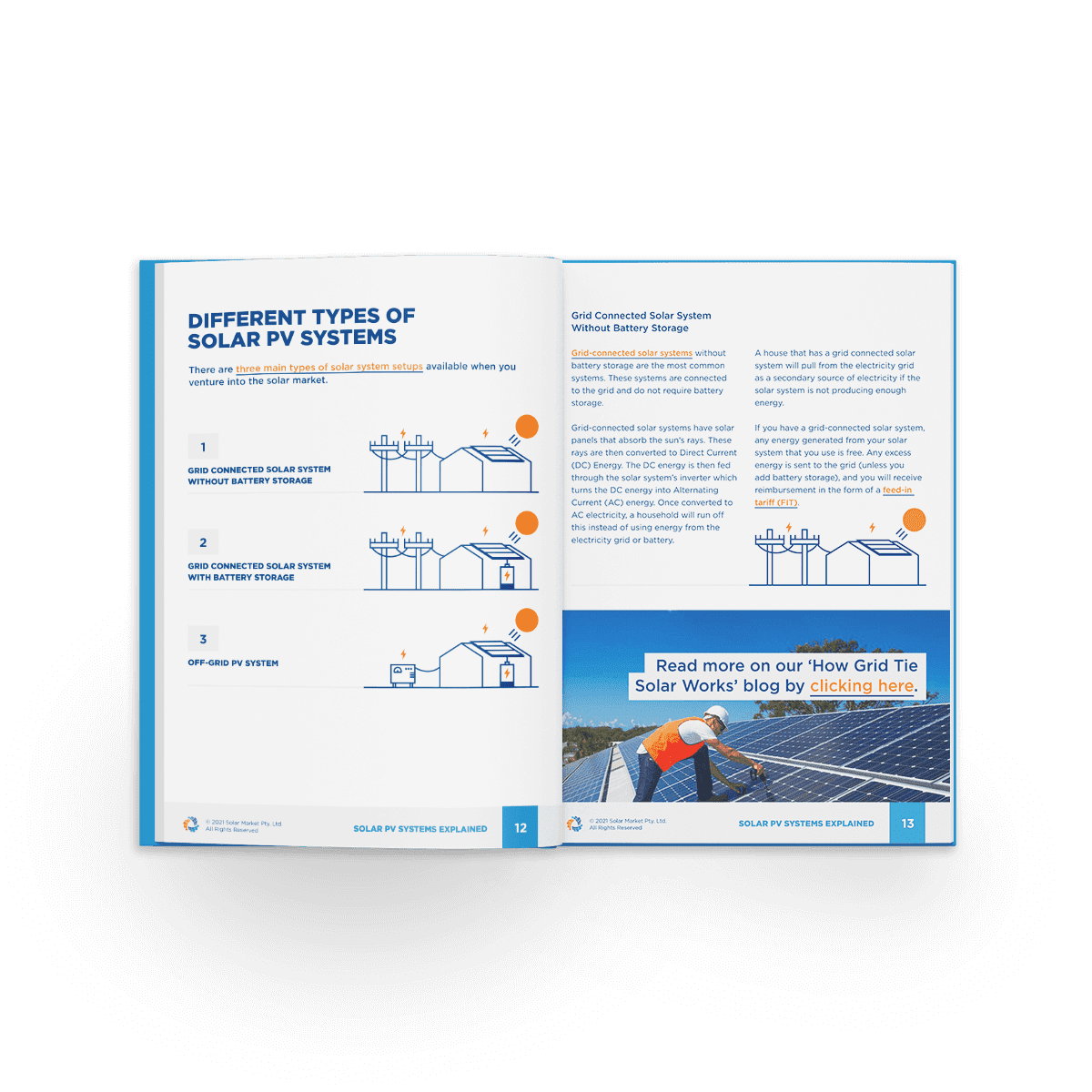

Labor’s electricity sector ETS is a “baseline and credit” scheme, based on a model proposed by the Australian Energy Market Commission (AEMC), which actually submitted the proposal to consultation on the safeguard mechanism.

This also places a baseline on the electricity sector, but it is calculated on the basis of emissions intensity (tonnes of emissions per unit of electricity generated) rather than overall emissions. Generators with emissions intensity below the baseline (for example, gas generators) would earn credit, so “cleaner” power plants would generate more credits.

Power plants that go over the baseline (for example, brown coal) would have to buy credits for the amount they go over. “Dirtier” plants would thus have to buy more credits.

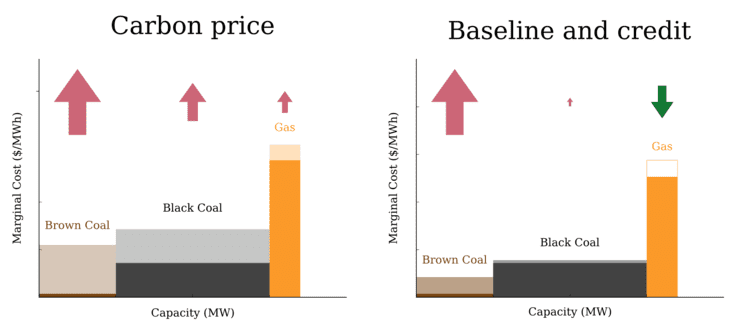

This is substantially different to a carbon tax or the previous emissions trading scheme. Under these policies, all generators are penalised, some more than others, as you can see in the figure below.

This difference is important for electricity prices. Dirtier plants would be expected to increase their selling price to cover the financial penalty on their emissions. But cleaner plants, earning revenue from selling credits, could afford to sell their electricity more cheaply.

This is important, because cleaner plants (typically black coal or gas) set the price. Gas in particular would probably be significantly cheaper under this proposal. As such, the impact on wholesale prices would be small, or negative.

In fact, as the AEMC itself noted, the impact on the wholesale market could be an increase or decrease in prices (depending on where the baseline is set).

The brown coal exit (Labor)

Another component of Labor’s climate platform is a plan to finance the closure of brown coal power stations, an idea first proposed by ANU climate economists Frank Jotzo and Salim Mazouz.

In this proposal, brown coal plants would bid for the payment they would require to finance their own shutdown, with the cheapest bid being selected. The remaining plants would pay this cost, in line with their emissions.

Similar to the ETS, it would be expected that this cost would be reflected in increased offer prices to the market from the remaining generators. The direct costs would be temporary (a one-off payment) and small, relative to the overall wholesale price.

Indeed, Jotzo and Mazouz estimated it could cause a one-off rise of 1-2% in retail power bills. Analysis company Reputex found the impact could be between 0.2% and 1.3%.

However, Danny Price of Frontier Economics has suggested that the scheme could push up retail power prices by between 8% and 25%, as the result of a short-term price shock. But given the significant excess capacity in the market, and assuming that the market is indeed competitive, it is hard to see how such a increase would happen.

This point aside, the price argument misses the point of the scheme, which aims to deliver an “orderly transition” away from brown coal. The longer-term effects on supply and price of a brown coal exit will be similar, regardless of how the industry closes.

In fact, if it were left entirely to the market, the sudden retirement of an entire power plant might create even more of shock. This proposal is chiefly about ensuring an orderly, predictable transition.

50% renewable energy target (Labor)

The final element of Labor’s climate platform is a 50% renewable energy target by 2030. At this stage, not much detail has been unveiled other than shadow environment minister Mark Butler’s pledge that it will be “designed in a way that does not disturb investor sentiment around the delivery of the existing Renewable Energy Target” – something that a sector beset by uncertainty would welcome. As such, it is quite difficult to speculate on how electricity prices might react.

The current Renewable Energy Target is a certificate scheme that requires retailers to buy a certain amount of renewable energy. The cost of these certificates is passed on through electricity bills. However, as shown by the government’s own modelling, the interaction with the wholesale market results in a net saving to consumers.

Interestingly, and as the AEMC points out, the electricity ETS is designed to be flexible and integrate with a renewable energy target. Indeed, such an ETS could drive investment in renewable energy, replacing current subsidies through the Renewable Energy Target. The 50% target could theoretically be achieved through the ETS alone, if the baseline was set at the right level.

A bipartisan approach?

As it stands, the government’s climate platform is unlikely to have any impact on electricity prices. However, it will also not have a major impact on the electricity sector’s emissions.

Labor’s policies will have an impact, but as the AEMC notes it may occur “without a significant effect on absolute price levels faced by consumers”.

The government’s current polices will require strengthening to further reduce emissions. To achieve this, the Grattan Institute and others including the Business Council of Australiahave supported ideas that would turn the Liberal platform into something very similar to Labor’s.

Indeed, modelling commissioned by the government itself assumes that Direct Action will eventually morph into a similar baseline-and-credit ETS, in order to meet long-term climate commitments.

Political slogans aside, perhaps a bipartisan approach is possible, without a significant effect on power bills.